DxSxT Network White Paper v1.0

DxSxT Network Vision and Declaration

Preface

In the surging wave of digital asset and protocol innovation, DxSxT Network emerges in an era that champions openness, fairness, and co-creation of value. We firmly believe that the future network will be user-centric, contribution-driven, and collaboratively governed by protocols.

Our Mission

DxSxT is not merely a single-function on-chain platform; it is a decentralized, multi-functional network infrastructure layer encompassing content creation, on-chain transactions, GameFi, ecosystem protocols, DePIN applications, and even AI model governance. We transcend boundaries, fostering a symbiotic and mutually beneficial environment for various participants, including creators, players, and protocol users.

Through the DST Token as a unified unit of value, DxSxT will bridge applications and contributions, actualizing an on-chain realm where everyone can participate and assert their rights.

Our Vision

Our vision is to build an unbounded decentralized value network, where innovation knows no limits, and participation equals ownership.

Slogan-style

DxSxT Network — An unbounded network world built for creators, players, and protocol users.

Legal and Risk Disclaimer

Risk Disclaimer & Legal Notice

This document ("Whitepaper") serves solely to provide technical, visionary, and token economic model information pertaining to the DxSxT Network project. It does not constitute investment advice, a fundraising solicitation, a guarantee, a promise, or a legal contract in any form. Please carefully read the following risk disclaimer and legal terms before participating:

1. Information Purpose Statement

- The content contained in this Whitepaper is for general informational purposes only. All data is based on the future development direction envisioned by the current project team.

- This document shall not be considered a securities prospectus, investment advice, financial service solicitation, or offering document in any jurisdiction.

- The content of this Whitepaper may be updated as the project progresses, through DAO resolutions, or due to technical adjustments. For the latest information, please refer to official communications.

2. Token Risk Statement

Holding or using DST Tokens involves the following significant risks:

Important Reminder: Investors should prudently assess their own risk tolerance and bear any financial losses independently.

3. Legal Restrictions and Regional Exclusion Statement

- This Whitepaper is not directed at or distributed to jurisdictions that prohibit, restrict, or regulate participation in crypto assets.

- If you are a resident or legal entity in such a jurisdiction, please do not participate in activities related to DxSxT Network.

- Users are obligated to confirm whether their participation complies with local laws and regulations.

4. Future Outlook and No Guarantee Statement

- The descriptions regarding DxSxT Network's development plans in this Whitepaper are merely goal-oriented vision statements and do not constitute legally binding commitments.

- No explicit or implied guarantees are made regarding project progress, token value, partnership advancements, listing progress, or other related content.

- All participants should understand that blockchain project development carries a high degree of uncertainty and may deviate from original plans.

5. Disclaimer of Liability

- The DxSxT Network team shall not be held liable for any direct or indirect losses that may arise from the use of the content in this Whitepaper or participation in this project.

- Users should exercise their individual judgment, seek professional legal, financial, and tax advice, and bear all risks associated with participation.

6. Intellectual Property Rights Statement

- Unless otherwise stated, all text, graphics, architecture, and technical designs within this Whitepaper are owned by or licensed to DxSxT Network.

- No one may reproduce, distribute, or use them for commercial purposes without prior written consent.

System Overview and Architecture

Protocol Architecture and Technical Architecture (Solana Version)

Core Modules and Data Flow

Core Functional Module

DxSxT Network adopts a modular design, where all protocol functions can be independently deployed, upgraded, and expanded according to actual needs. The main modules include:

Client and Wallet

- Supported Wallets: Phantom, Solflare, Backpack (using Solana Wallet Adapter standard)

- Login and Signature: SIWS (Sign-in With Solana), message signature anti-phishing verification, source domain binding.

- Transaction Experience:Single/batch signature, priority fee suggestions, error classification (slippage/balance/permissions).

- Key Management: MPC and social recovery (non-custodial), multi-signature and whitelisted address management.

- Caching and Synchronization:IndexedDB caecent transactions and account snapshots, offline draft signatures, automatic synchronization after recovery.

- Development Kits: Web SDK, React Native SDK, server-side signing auxiliary tools.

Protocol/Contract Layer

- Contract Modules: Transaction Engine, Liquidity Mining, DAO Governance, DST Token, Protocol Adapters (Plug-in).

- Account Model: PDA (Program Derived Address) for state management; resource naming and permission domains standardized by seeds.

- Events and Logs: Critical operations emit events for indexers/dashboards; error codes and event names are standardized.

- Upgrade Governance: DAO controls upgrades via Governance programs; Timelock + multi-signature for execution.

- Compatibility: Compliant with SPL Token/Metadata; integrated with Wormhole for cross-chain asset mapping.

- Security Baseline: Re-entrancy protection, mathematical overflow checks, privilege separation, emergency pause.

Performance and Usability Goals

Technical Foundation Design

Advantages of Solana Mainnet Deployment

Performance Advantages:

- High TPS: Theoretically capable of processing 65,000+ transactions per second.

- Low Latency: Approximately 400ms block confirmation time.

- Low Cost: Average transaction fee < $0.01.

- High Throughput: Suitable for high-frequency interactive applications (GameFi, DePIN, DEX).

Technical Advantages:

- Rust Language: Memory safety, high performance, zero-cost abstractions.

- Parallel Processing: Sealevel parallel runtime, supporting thousands of smart contracts executing in parallel.

- Proof of History (PoH): Provides a global timestamp, ensuring transaction order consistency.

Cross-chain and Interoperability Cross-chain Protocols (XCMP/CCIP/IBC/Self-developed)

Cross-chain Scalability Design

Short-term Plan:

- Integrate Wormhole as the primary cross-chain bridging protocol.

- Support cross-chain assets for Ethereum, BSC, and Polygon.

- Achieve DST Token circulation on mainstream chains.

Mid-term Plan:

- Integrate Hyperlane as a backup cross-chain solution.

- Support chains like Cosmos, Avalanche, Arbitrum.

- Implement a cross-chain governance right synchronization mechanism.

Long-term Plan:

- Deploy to Solana Subnet for higher performance.

- Utilize Eclipse or Saga to build a dedicated Appchain.

- Achieve fully decentralized cross-chain asset management.

Smart Contracts and Developer Experience

Technical Architecture & Development Stack

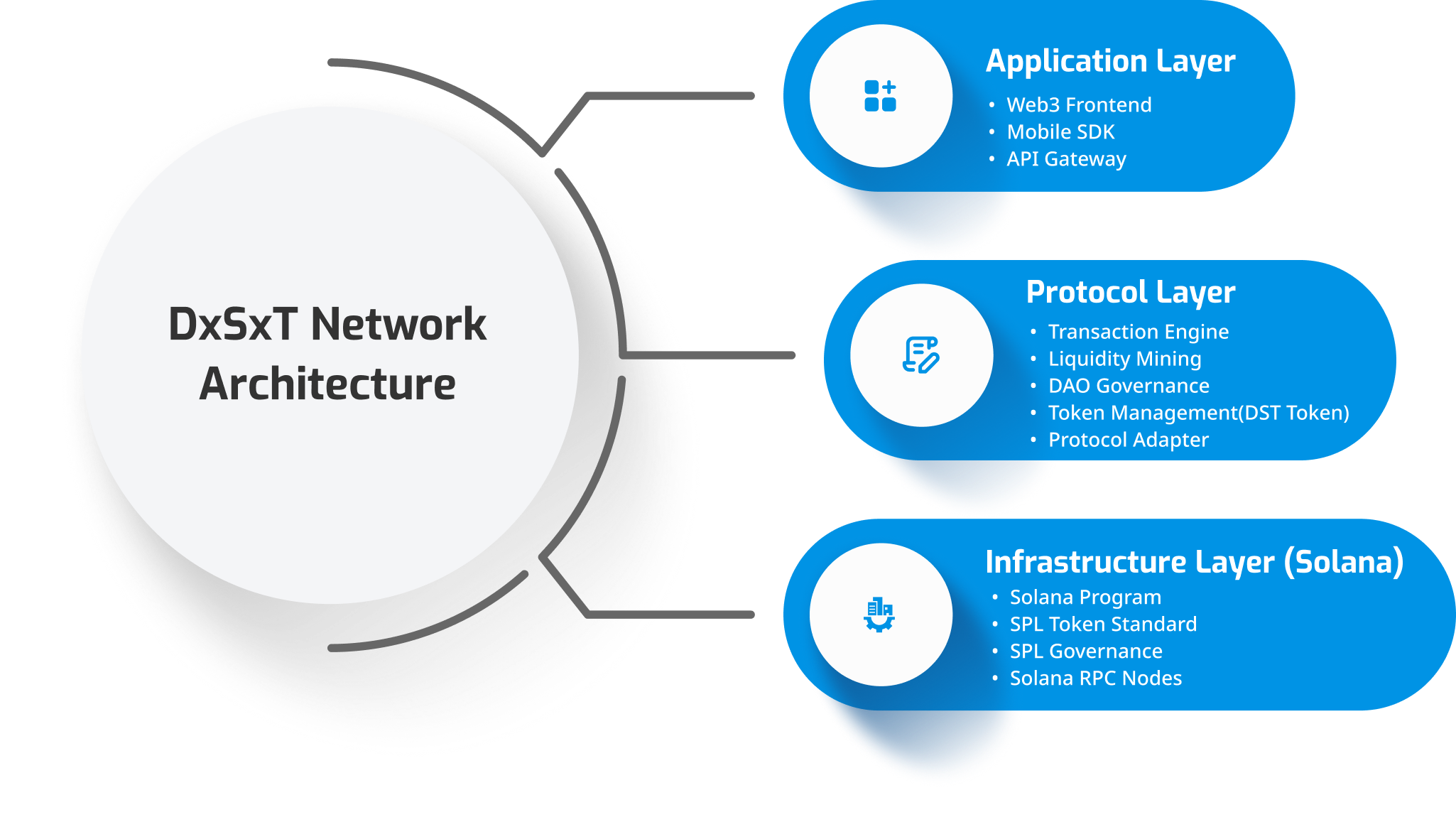

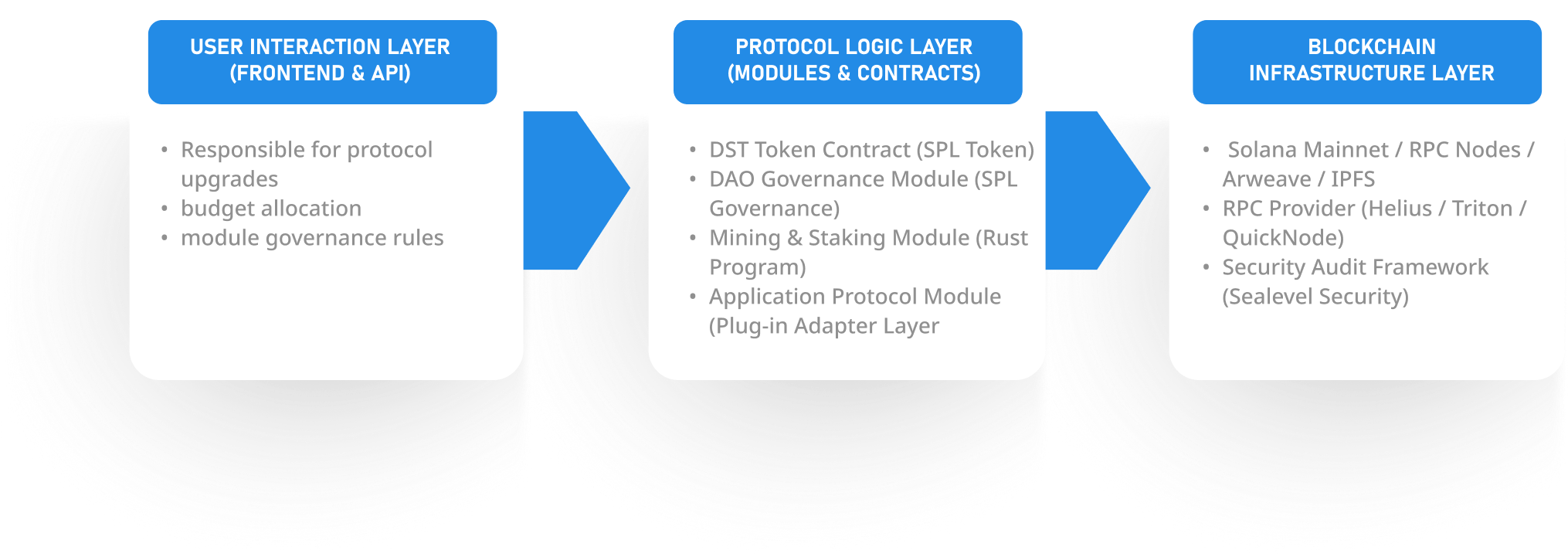

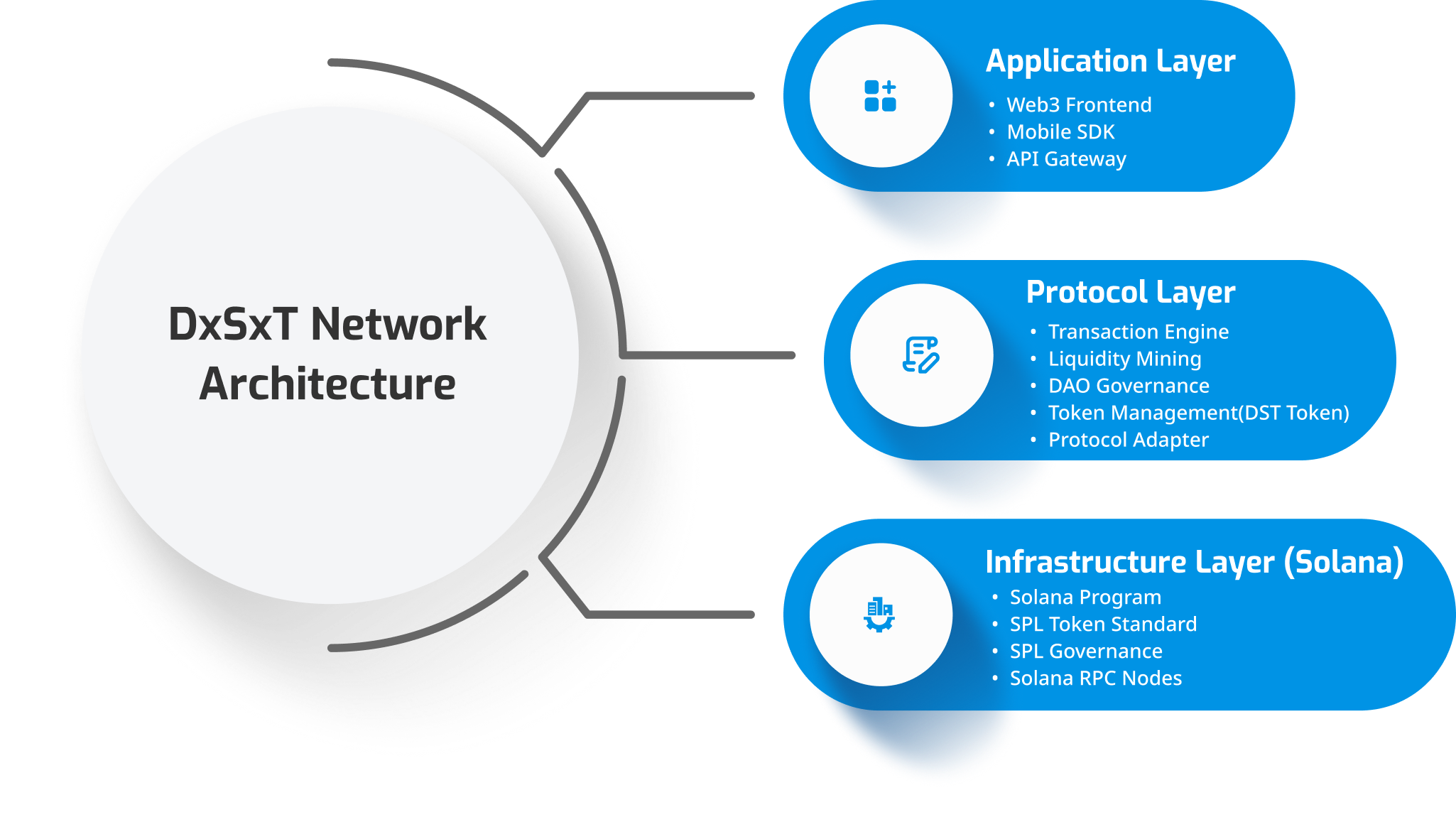

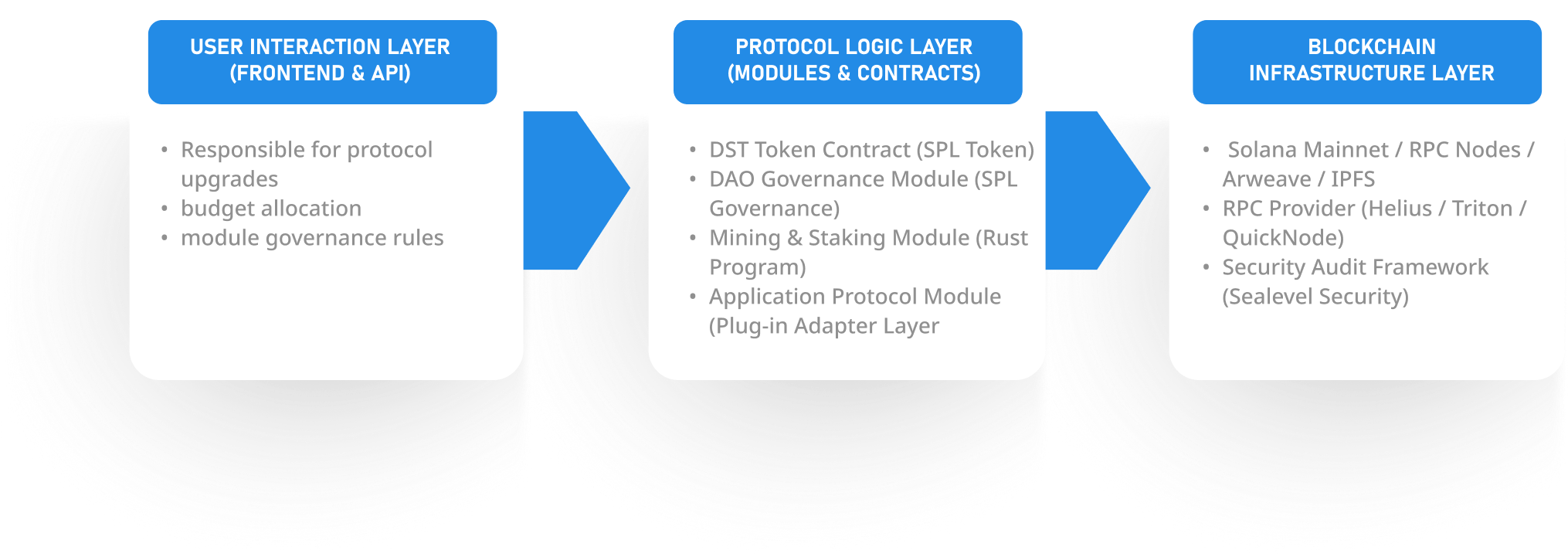

DxSxT Network adopts a highly modular, three-layered architecture, combining the high performance and decentralized characteristics of the Solana mainnet to achieve a scalable, pluggable, and low-barrier blockchain application ecosystem.

Core Architecture Design Diagram

Overview of Development Technology Stack

Mobile Architecture Supplement

Testing and Deployment Environment

Security and Governance Risk Control Measures

Module Development and Integration Guide (Developer Expansion)

- Provides Plug-in SDK kits (TypeScript + Rust).

- All protocol modules support Interface Definition Language (IDL) standards.

- Ecosystem developers can propose new modules for deployment via Builder DAO.

- Integrated modules can customize fees, verification, and governance permissions.

Tokenomics and Fee Model

Changing the Token's Economic Model via DAO Voting Proposals

Token Functions and Use Cases

Token Utility

DST is the core token of DxSxT Network, designed for multi-functionality and ecosystem integration:

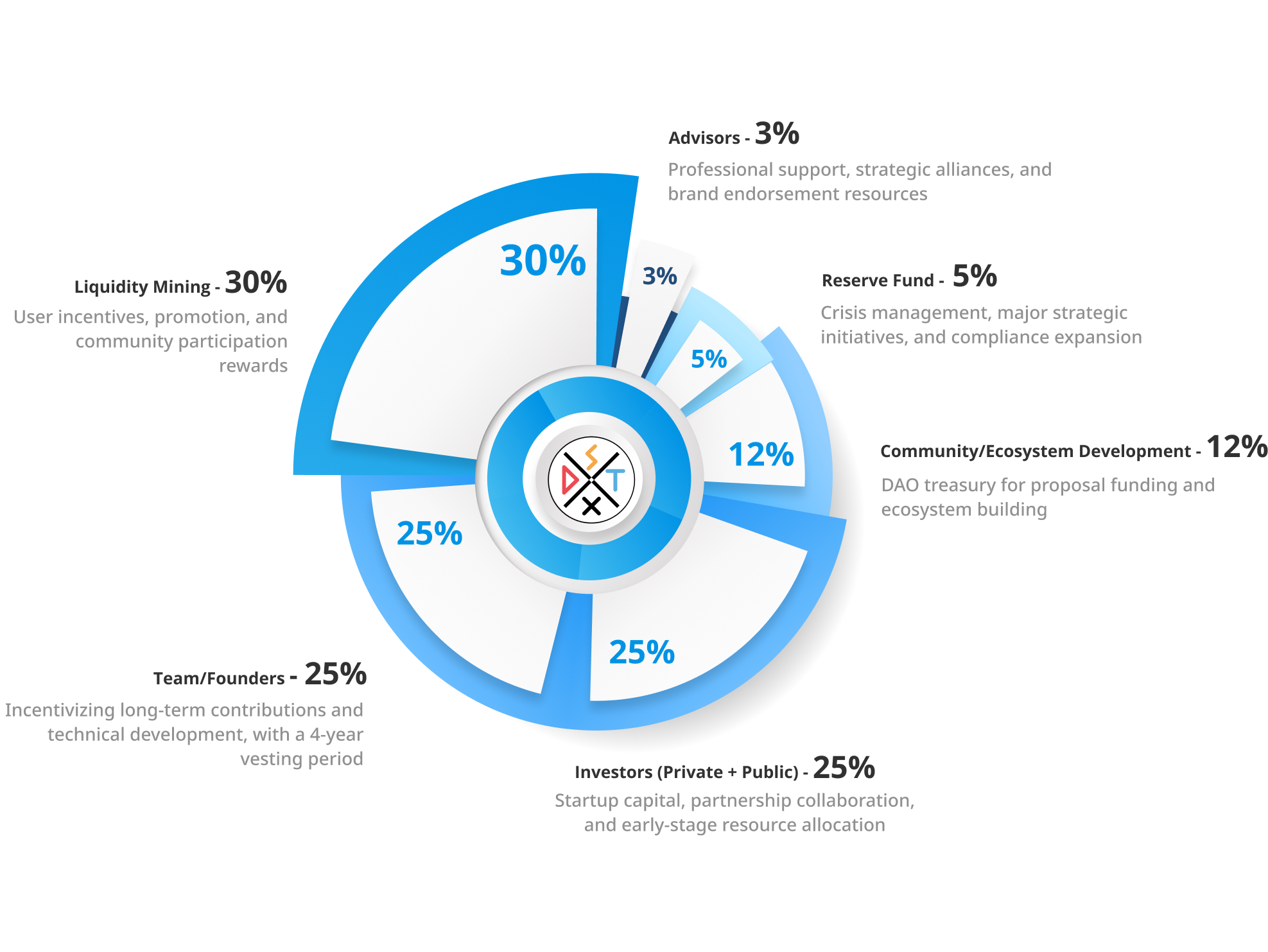

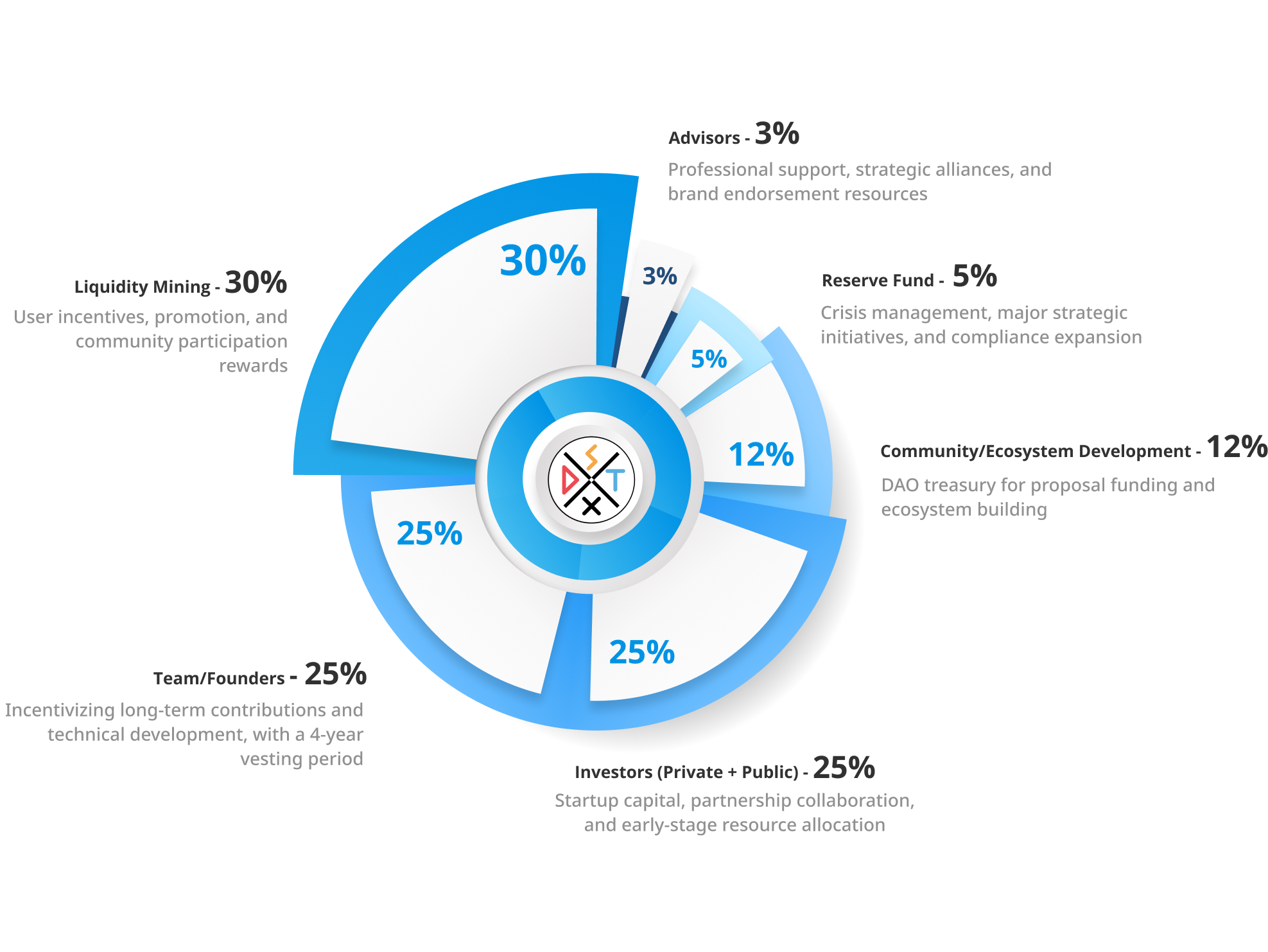

Supply, Distribution, and Release Token Information

Distribution Ratio

Vesting and Unlocking Mechanism (Vesting)

Public Offering and Reserve Funds (Vesting)

Note: TGE (Token Generation Event) refers to the time point when tokens are first generated and can be distributed, typically the beginning of the project's official token issuance phase. TGE is not equivalent to exchange listing but often occurs close to or concurrently with it.

Staking and Slashing Mechanism

Adopts the veDST staking model:

- The longer the lock-up period, the higher the governance weight and staking yield.

- Supports dynamic lock-up extension and weight stacking.

- No general slashing rules are set; governance-related restrictions are based on unlock status and task completion.

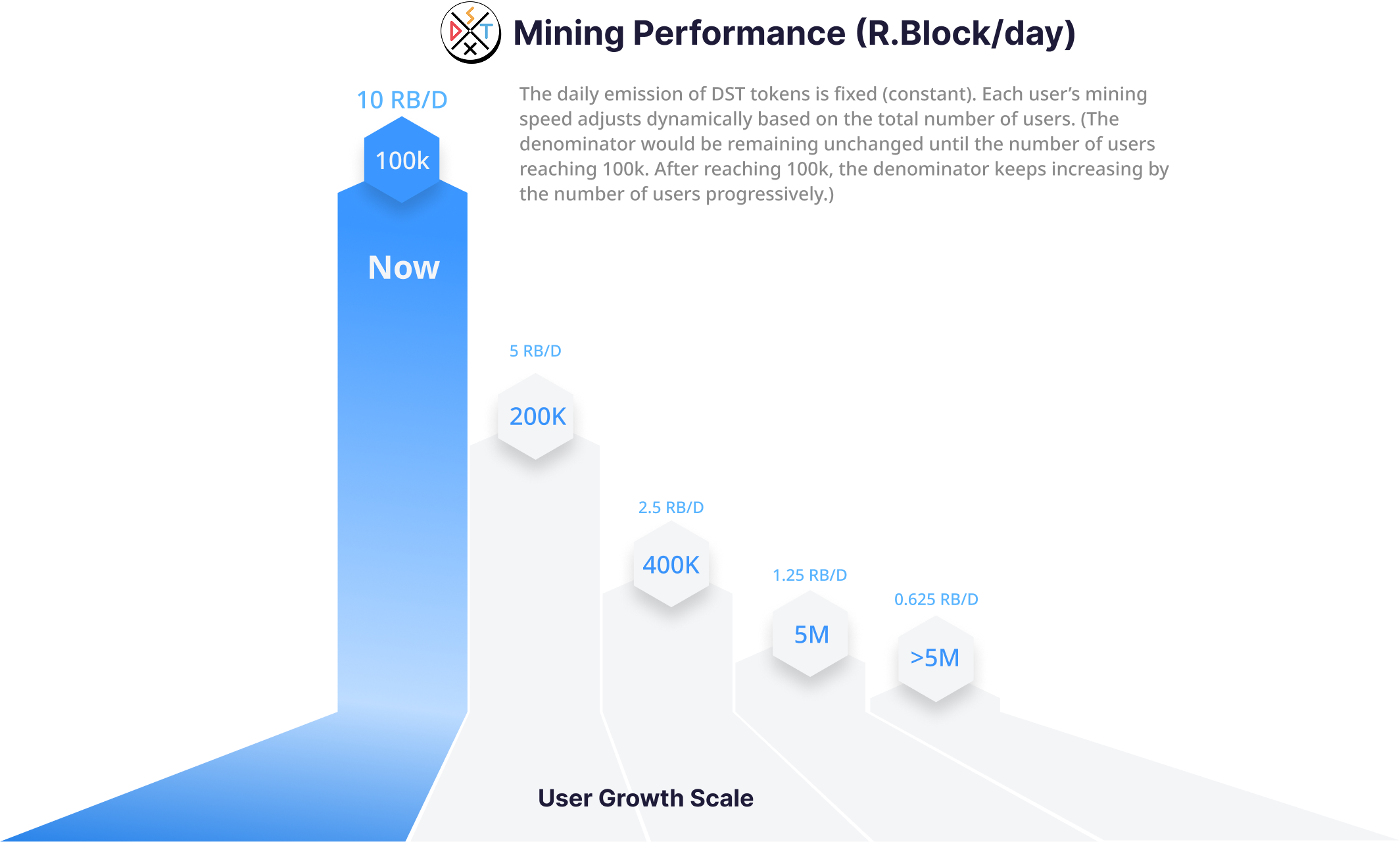

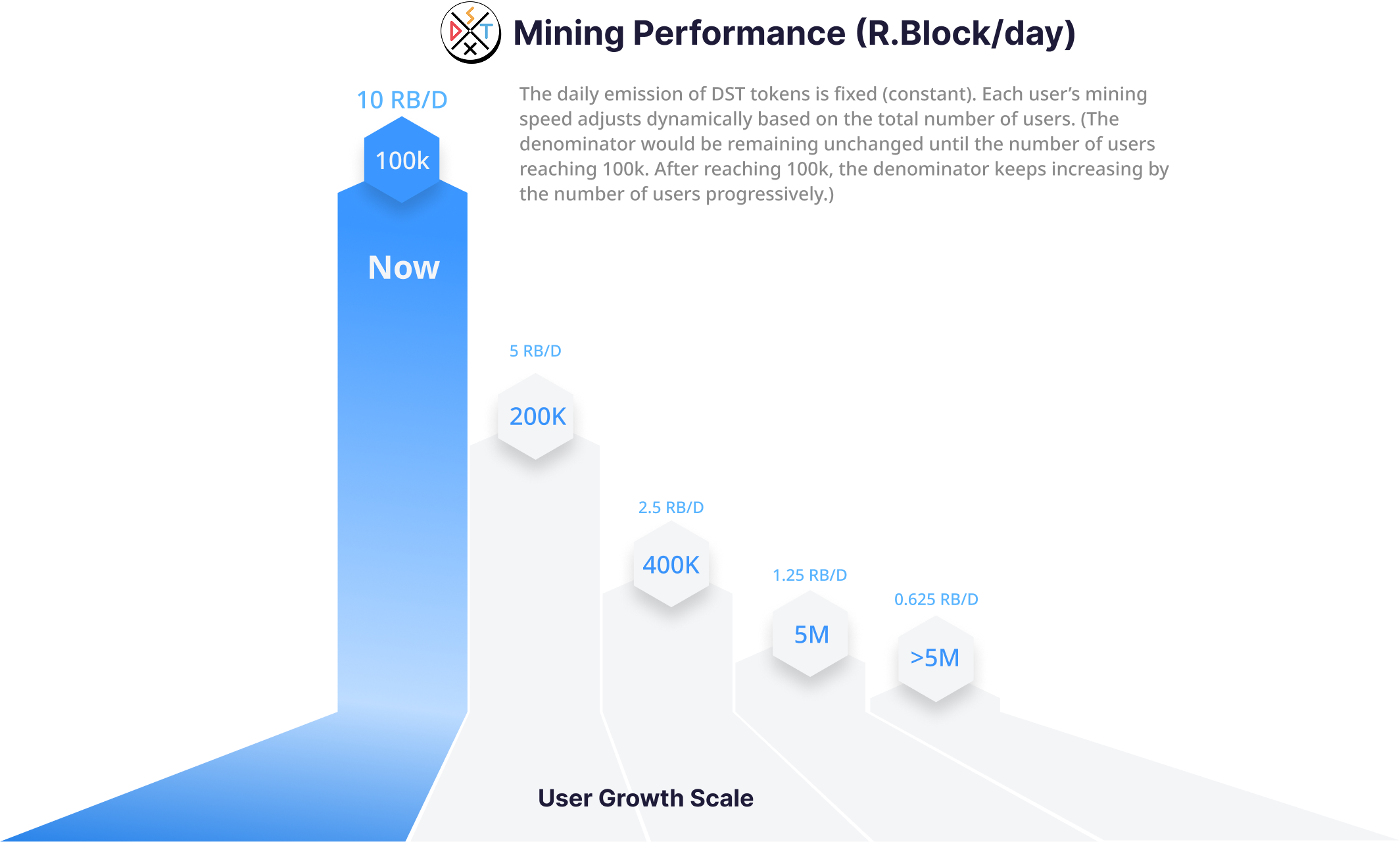

Revenue and Participant Model Liquidity Mining Distribution Mechanism

Notes and Governance Instructions

- Each halving will automatically execute upon reaching a specific "number of active on-chain addresses" and be announced on the DAO dashboard.

- 30 days prior to a halving, a forecast of changes in distribution will be announced to ensure market expectations and information symmetry.

- Future halving logic and parameters can be adjusted by DAO vote, and subdivided halving phases can be dynamically added based on module requirements.

- Important Note: The annual release of 180M DST originates solely from the existing 30% liquidity mining allocation (totaling 1.8B DST), not from newly issued tokens. The current total supply remains at 6 billion.

- Should additional issuance or adjustments to the supply model be required in the future, it must undergo review and voting through the DAO governance mechanism, ensuring transparency, fairness, and community consensus.

Long-term Impact:

- Increased Scarcity: Task rewards transition from rapid growth → stable distribution → ultra-long-term precise incentives.

- Elevated Participation Value: Early task participants will become beneficiaries of value accumulation.

- Governance-led Transformation:Later, the focus of value shifts from mining to module operation and governance participation.

DxSxT's halving mechanism is a "human-centric" distribution control model, synchronizing value growth highly with contribution and participation, establishing a predictable, governable, and sustainable token release logic.

Ecosystem Application Scenarios and Value Flow Path

DxSxT Network is not just a set of protocols and a token mechanism; it is an open and extensible on-chain value network. Through the design of the DST Token and its modular protocol architecture, various roles such as creators, players, protocol developers, and contributors can participate, forming a tangible flow of value.

GameFi Application Scenarios

DxSxT will provide a GameFi SDK, enabling third-party developers to quickly integrate DST-driven reward and governance modules.

AI Model Training and Governance

DxSxT plans to develop an "on-chain AI model pool" to support multi-model governance and DST reward distribution.

Content Platform and Creator Economy

DxSxT supports "content as an asset," allowing creators to put their works on-chain and customize NFT sales and licensing rules.

Value Flow Characteristics of DxSxT Network

- Multi-role Interaction Design:Creators, players, and node operators can all contribute and benefit.

- Modules as Economic Interfaces:Each module serves as a value inflow point and exchange arena.

- Token Flow Closed Loop: The acquisition, consumption, staking, and governance of DST form a positive cycle.

- Resources as Value: Whether it's computing power, creation, data, or time, any contribution can be tokenized.

Governance and Forkless Upgrades

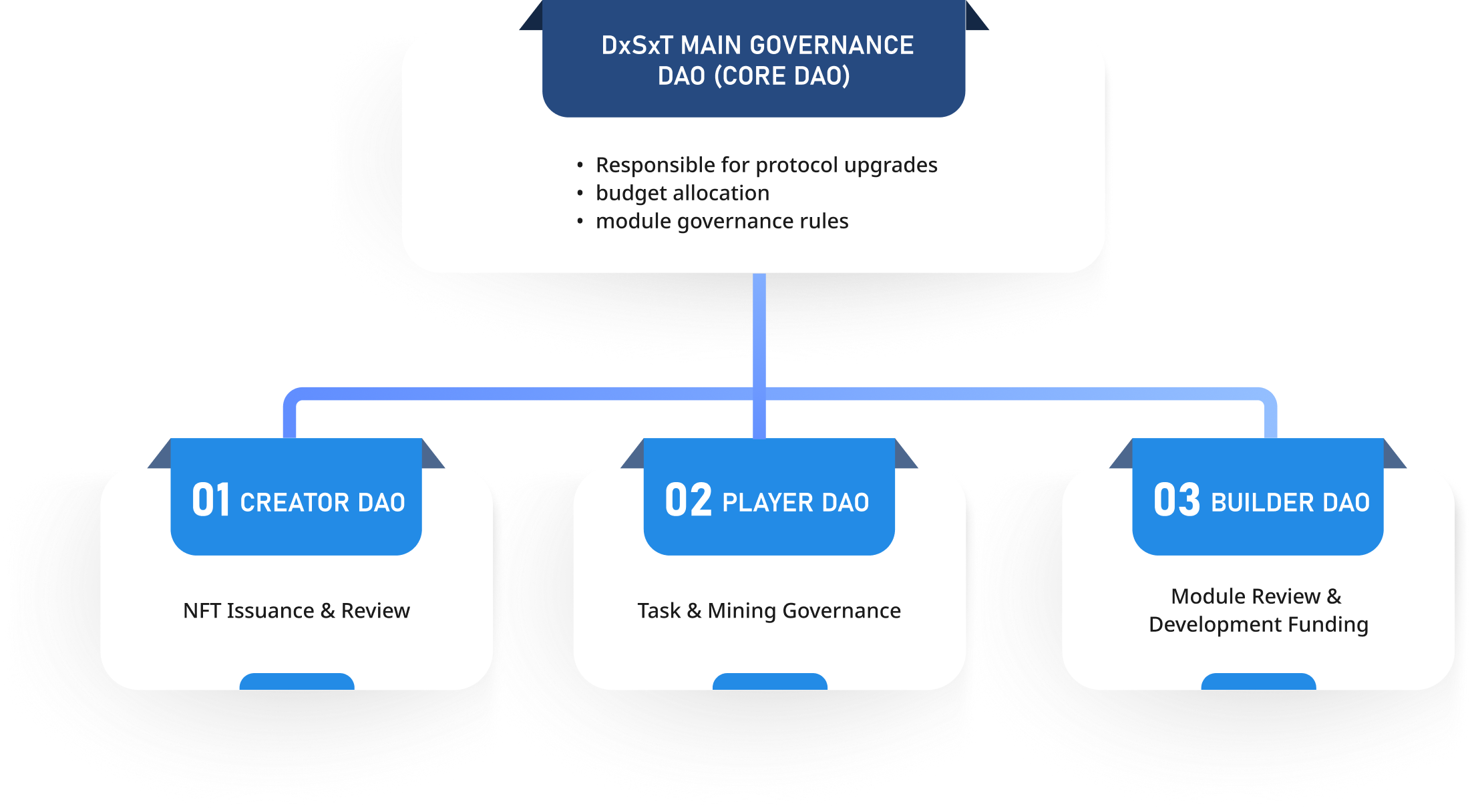

Decentralized Autonomous Organization (DAO) Governance

DxSxT Network adopts a phased decentralization of governance, establishing an open, transparent, and scalable DAO architecture. This ensures that protocol upgrades, fund allocations, and module integrations are jointly decided and overseen by the community, thereby realizing an on-chain realm where "everyone participates and everyone asserts their rights."

Governance Design Principles

- Decentralization: DAO drives all major decisions.

- Contribution-Oriented: veDST determines governance weight and eligibility.

- Financial Transparency: Treasury expenditures are traceable, proposable, and vetoable.

- Modular Governance: Supports the coexistence and operation of multiple DAO sub-organizations.

- Risk Control: Establishes cooling-off periods, multi-signature verification, and prevents governance abuse.

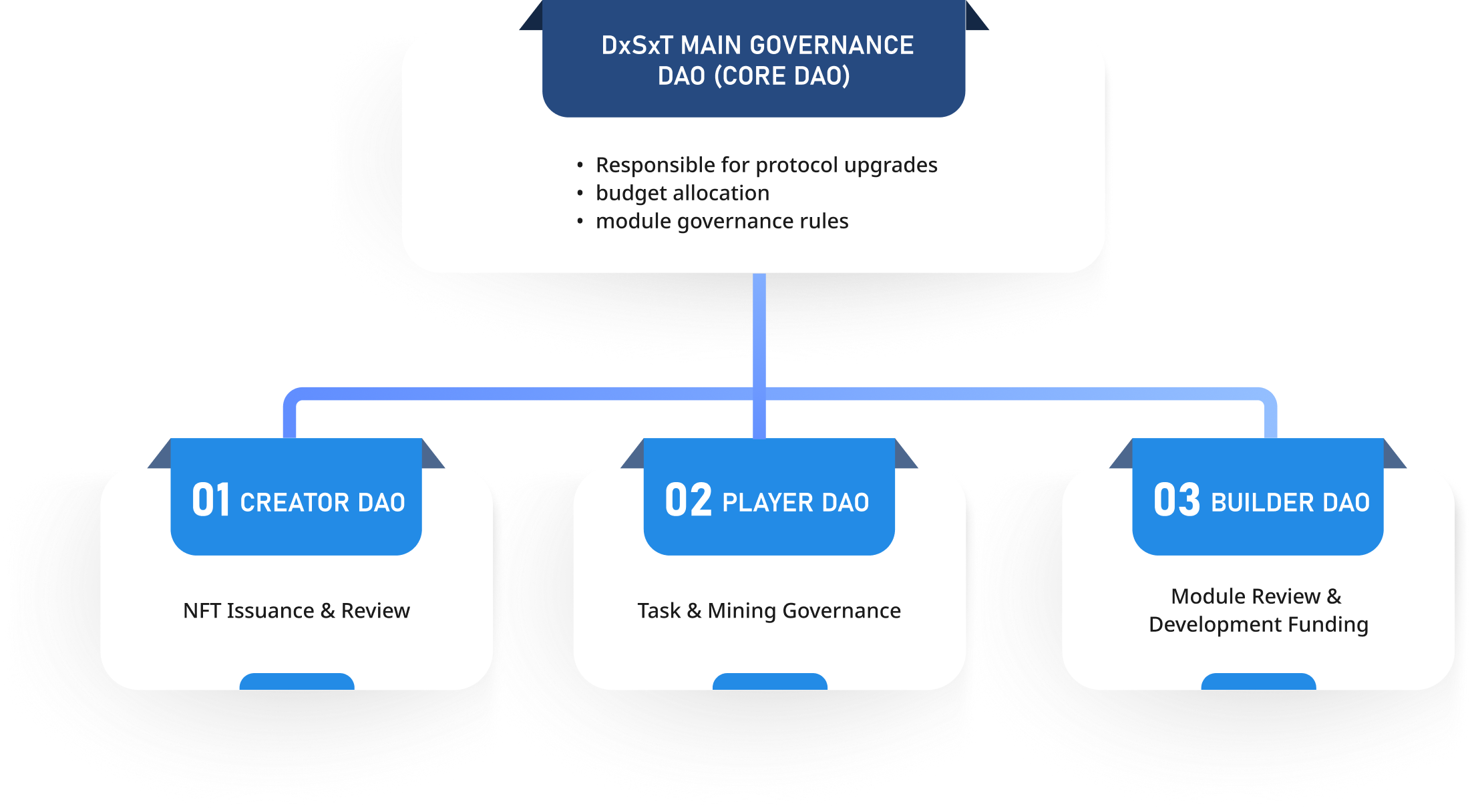

DAO Architecture Composition Diagram

veDST Governance Weight Model

Calculation Formula: Voting Weight = Locked DST Quantity × Lock-up Time Coefficient (veDST)

Functional Permissions: Proposing, voting, reviewing treasury allocations, module listing review.

Security Mechanisms:

- Prevent vote mining: Governance actions do not directly award rewards, avoiding manipulation.

- Anti-monopoly mechanism: A single address's governance weight is capped at 5% of the total weight, preventing control by large holders.

Proposal and Governance Process

DAO Treasury Management Mechanism

Governance Tools and Community Platforms

Future Direction of Governance Evolution

- Opening of sub-DAO autonomous systems for proposals and certification mechanisms (DAO-as-a-Service).

- DAO identity system (SBT / NFT symbolizing contribution history and reputation).

- Governance contribution leaderboards linked to veDST rewards.

- Ethical review and blacklist module to prevent malicious manipulation or fraudulent DAOs.

- Collaboration agreements with external DAOs (e.g., cross-DAO joint governance, module alliances).

Summary of Governance Philosophy

The DAO governance architecture of DxSxT Network is not merely "whoever has tokens decides"; instead, it is built upon contribution time + commitment to hold (veDST), establishing a fair, secure, and scalable governance system through multi-layered proposal and review processes. This ensures that the community truly drives platform evolution and value distribution.

Security Model and Risk Control

Security & Compliance Design

The foundation of decentralized applications is "trust derived from mechanisms, not individuals." DxSxT Network regards security and compliance as core values in its protocol design, establishing a robust and trustworthy operational assurance mechanism across smart contracts, security modules, governance processes, and potential legal risks.

1. Smart Contract Security Strategy

2. System and Client Security

3. DAO Governance Risk Control

4. Compliance and Legal Risk Response

Summary of Security Philosophy

DxSxT Network is committed to building a decentralized infrastructure network that possesses technical security + mechanistic credibility + compliance flexibility. We deeply understand that only by establishing a trustworthy protocol foundation can the entire token economy and community governance operate sustainably for the long term

Ecosystem, Collaboration, and Business Model

Incentive and Fund Programs

Incentive & Contribution Model

In DxSxT Network, incentives are not just economic returns; they are the core mechanism for maintaining the vitality and sustainable development of the decentralized network. Through a multi-layered contribution model based on DST Token, we aim to build an on-chain consensus community where "participation equals contribution, and contribution equals value received."

Multi-tiered Contribution Roles and Incentive Mechanisms

Activity Points System (XP System)

To promote daily participation, DxSxT will introduce an XP (eXperience Points) system. All on-chain/off-chain contributions can earn XP, and DST or DAO voting rights will be regularly airdropped based on XP rankings.

veDST Staking Model (Staking & Governance Weight)

DxSxT adopts an improved veToken model (voting escrow) as the basis for staking and governance participation:

Core Features:

- The longer the DST is locked up, the higher the corresponding veDST weight.

- veDST can influence: voting weight, module usage priority, airdrop distribution ratio, DAO proposal threshold, etc.

- veDST is non-transferable during the lock-up period; if tokenized as an NFT, it may allow secondary market trading of lock-up certificates.

DAO Builder Incentive Grant

To encourage protocol builders and application developers to continuously create value, the DAO treasury will reserve 12% of DST for subsidies and incentives, executed in three categories:

- Module Deployment Subsidy: For GameFi, AI, NFT, and other Plug-in module developers, regularly distributed based on usage or community rating.

- Education and Content Creator Subsidy: DST rewards for those who create educational materials, translations, documentation, and videos.

- Community Promotion Ambassador Program: Electing ambassadors by region/language to conduct localized promotion and educational activities.

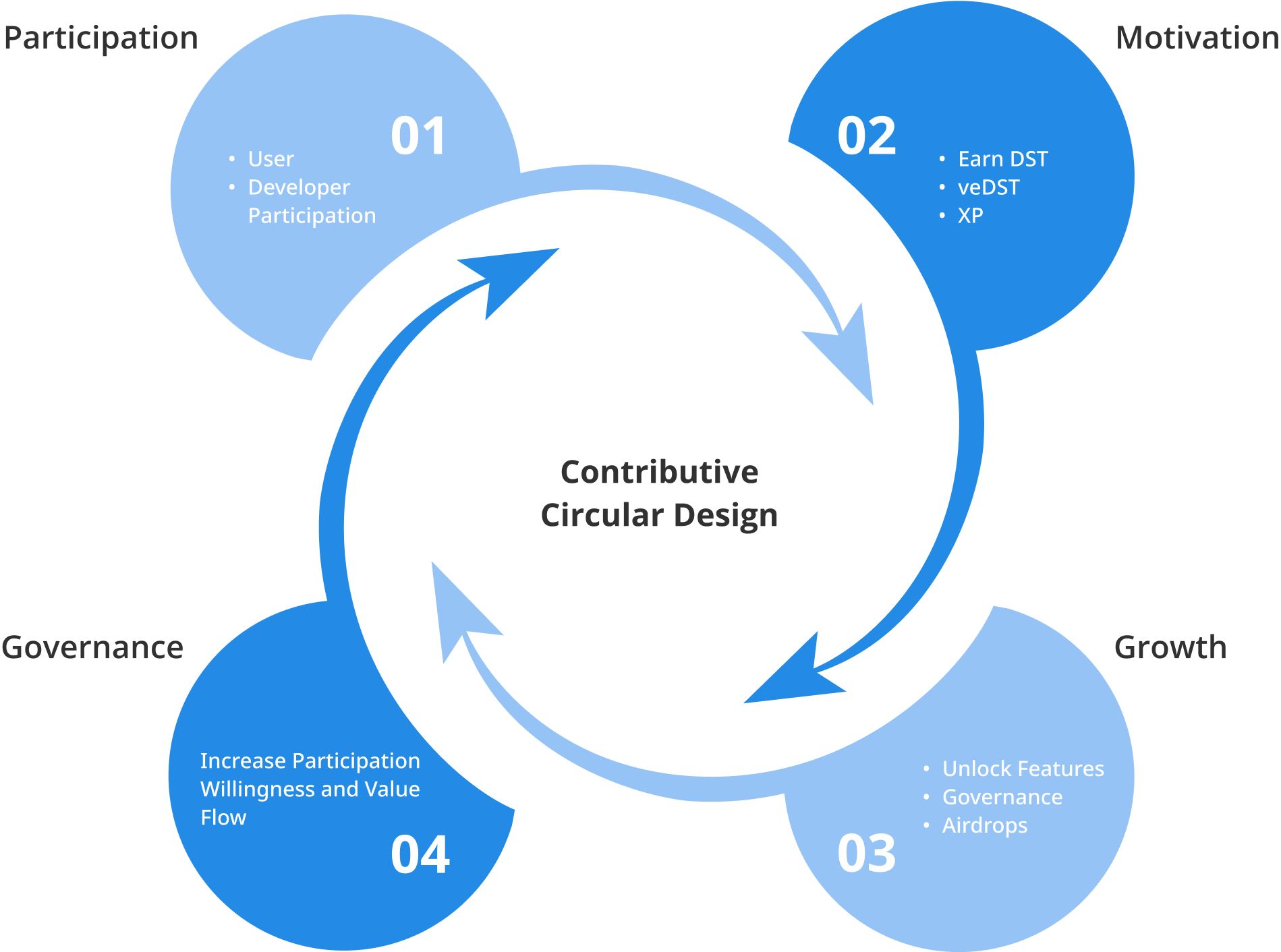

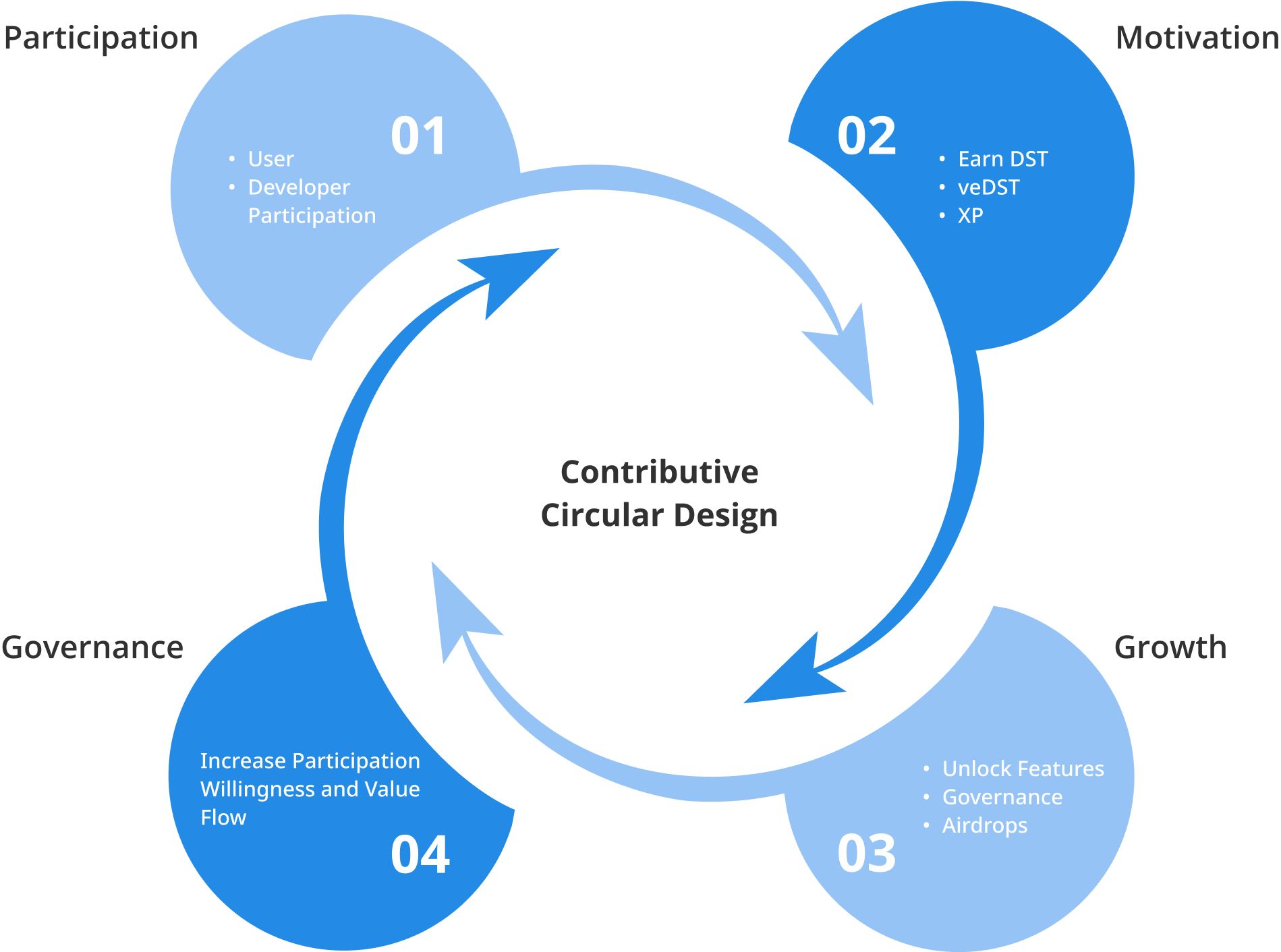

Contribution Cycle Design: Participation → Motivation → Growth → Governance

Motivation System Philosophy

The DxSxT motivation system will not just be a cold "reward mechanism"; it will be the fundamental value basis for the entire network's self-operation, self-governance, and self-evolution.

Roadmap and Milestones

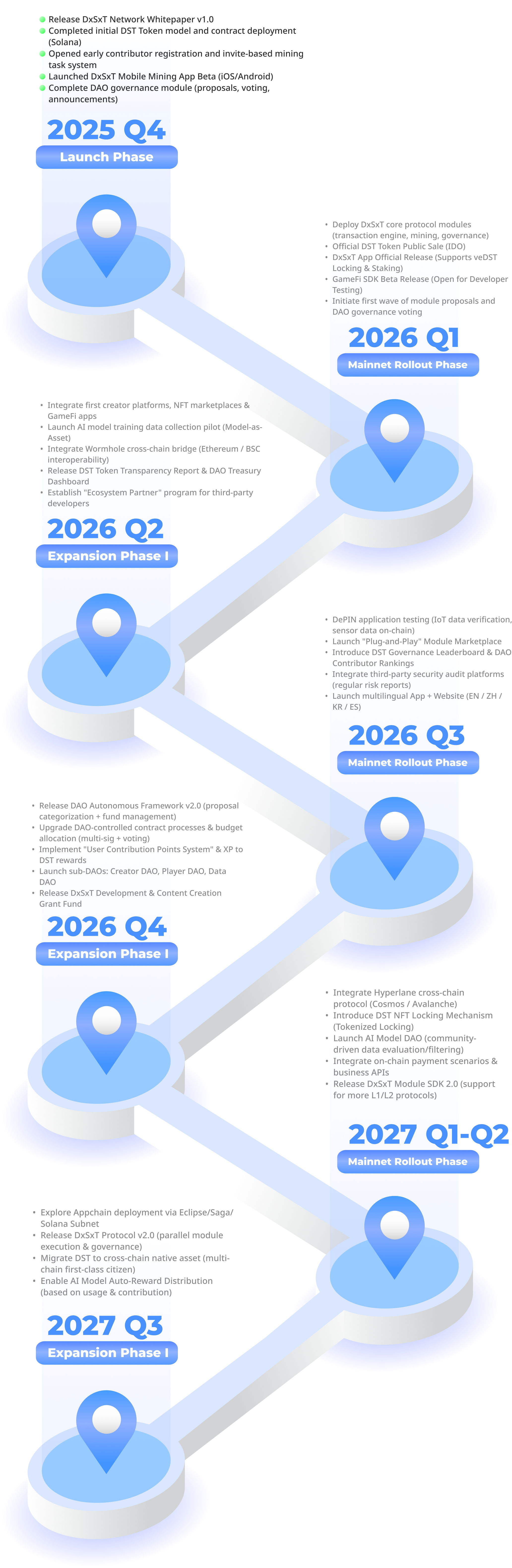

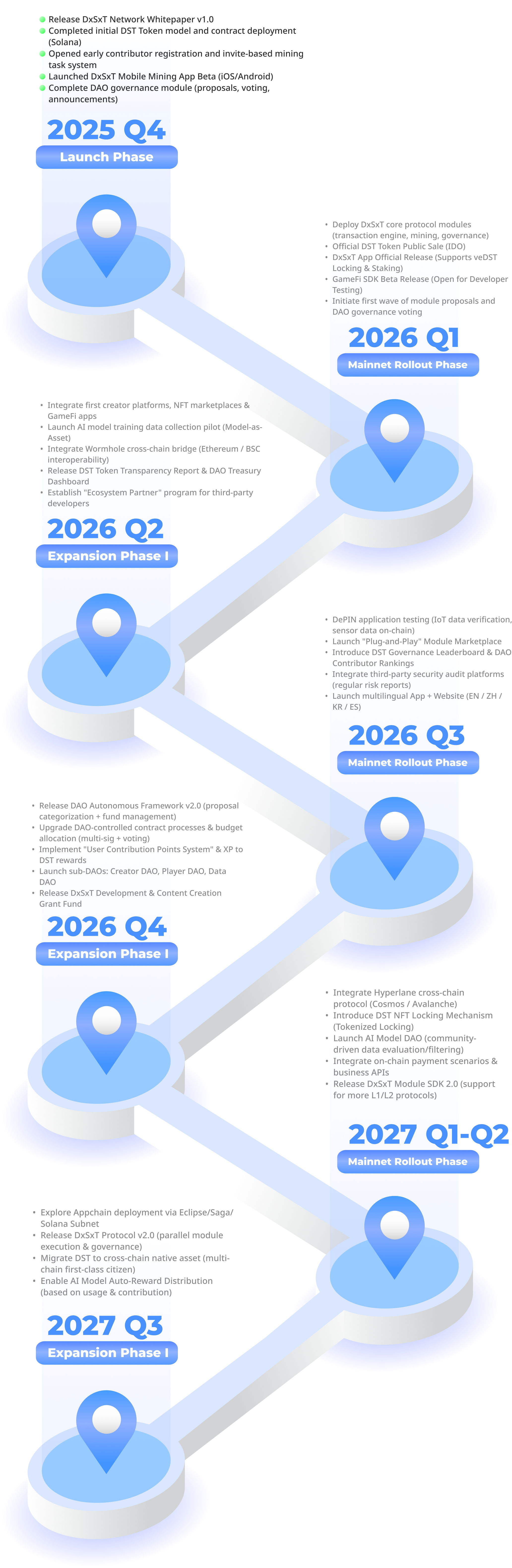

DxSxT Network Roadmap

DxSxT Network will adhere to the principles of modularity and phased progression, steadily advancing its core protocols, mobile applications, ecosystem partnerships, and governance decentralization. The ultimate goal is to achieve a highly participatory, high-value-flowing decentralized value network.

Additional Notes

- The roadmap is a dynamic, rolling plan that will be adjusted based on DAO decisions, community suggestions, and partnership advancements.

- All progress will be regularly announced and updated via the DxSxT official website and governance forum.